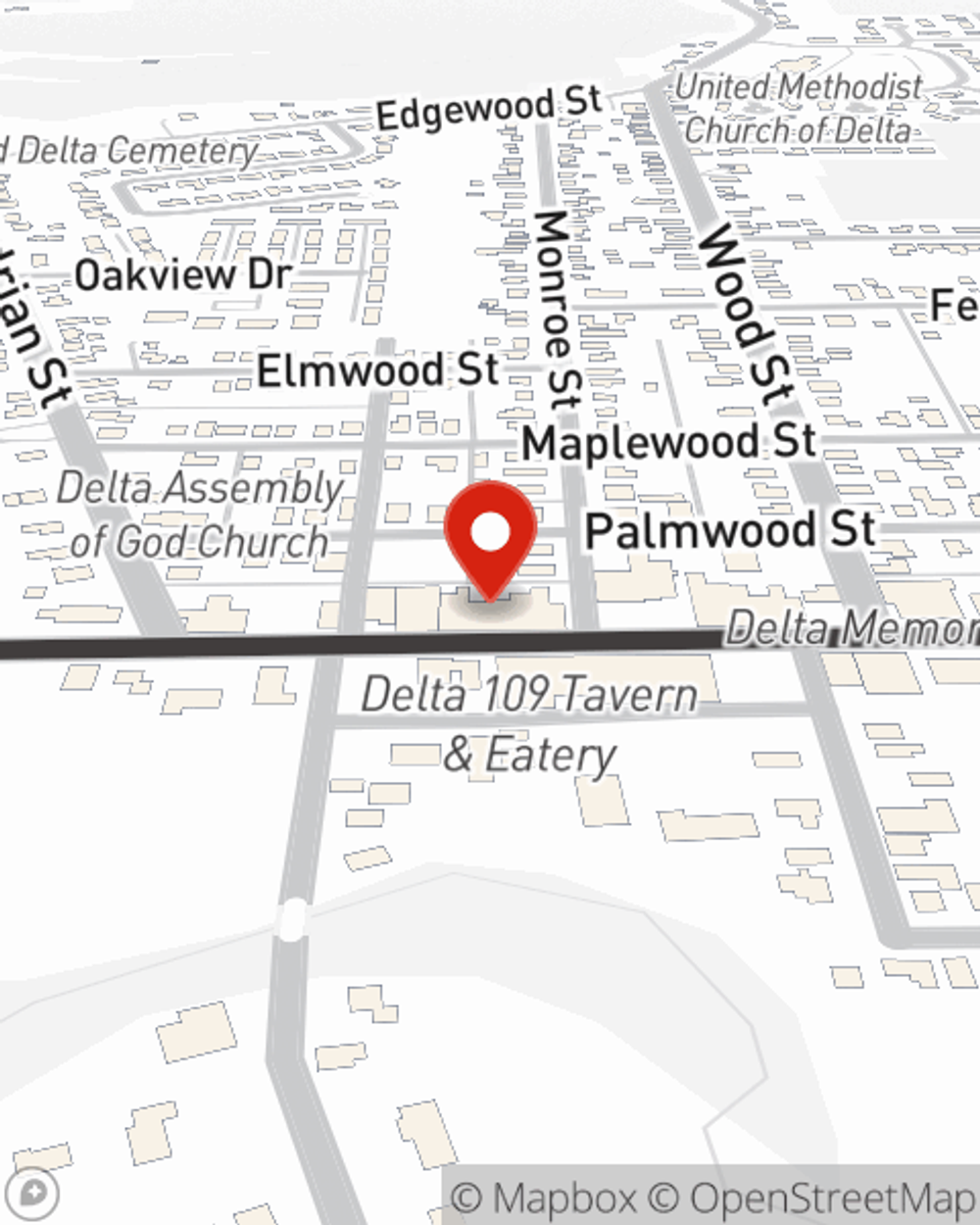

Business Insurance in and around Delta

Delta! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Coverage With State Farm Can Help Your Small Business.

Running a small business comes with a unique set of highs and lows. You shouldn't have to face those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including errors and omissions liability, a surety or fidelity bond and business continuity plans, among others.

Delta! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Strictly Business With State Farm

At State Farm, apply for the outstanding coverage you may need for your business, whether it's a dry cleaner, a pet groomer or a pizza parlor. Agent David D Hardy is also a business owner and understands what you need. Not only that, but exceptional service is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

Reach out agent David D Hardy to talk through your small business coverage options today.

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

David D Hardy

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.